When it comes to buying or selling property in India, taxes are an important part. One such tax is the Tax Deducted at Source (TDS) on the sale of property under Section 194-IA. Property here refers to only immovable property like land and buildings. Before making a payment to the seller, buyer has to deduct tax at the time of purchasing property.

- Buyer must deduct TDS at 1% of the total sale amount. Buyer deducts TDS, not the seller.

- TDS applies only if purchase value is Rs.50 lakh or more.

- If payment is by installments, TDS must be deducted on each installment at payment time.

- TDS is on the entire purchase value.

- Buyer does not need TAN; payment can be made with PAN.

- Buyer must obtain seller’s PAN; otherwise TDS deducted at 20%.

- TDS payment made using Form 26QB within 30 days from the end of month TDS was deducted.

- Buyer must furnish Form 16B TDS certificate to the seller 10-15 days post payment.

- Buyer and seller registered on Income Tax site.

- Type of Property and address.

- Address of buyer and seller.

- Date of Agreement.

- Total Value of Consideration.

- Payment Type – Lump sum or Installments.

- Amount for TDS deduction and TDS amount.

- Date of Deduction and Payment.

Note: Section 194IA is not applicable if property is purchased from a Non-Resident. Buyer should have TAN and deduct TDS as per Section 195. If multiple persons jointly purchase a property, each must acquire TAN.

- TDS on sale by NRIs ideally deducted on capital gains, calculated by income tax officer.

- Seller submits Form 13 to IT department via TRACES for capital gain calculation.

- IT department provides certificate for nil or lower TDS deduction.

- Seller furnishes certificate to buyer who deducts TDS per certificate.

- If certificate not obtained, TDS deducted on sale value; surplus TDS claimable in returns.

- If co-owners, each must furnish Form 13 separately.

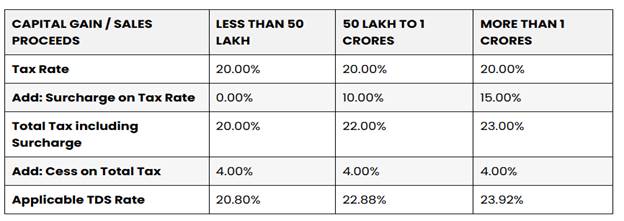

Effective TDS rate on sale consideration for long-term capital assets (held > 24 months) up to 22nd July 2024 (without lower deduction certificate):

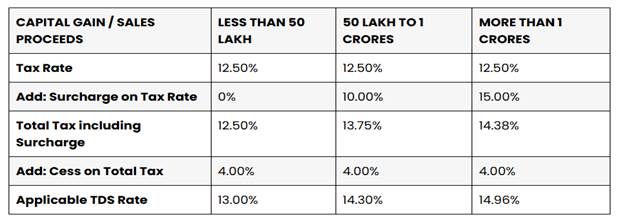

Effective TDS rate on sale consideration for long-term capital assets on or after 23rd July 2024 (without lower deduction certificate):

*If a Lower Deduction Certificate (LDC) is issued by the Assessing Officer considering capital gains, that lower rate applies for TDS calculation. Amount applied is sale consideration. Note: The beneficial provision of choosing 12.5% without indexation or 20% with indexation (for properties acquired before 23-07-2024) is not available to NRIs.

- TDS at 30% (plus surcharge & cess) on total sale value if no lower deduction certificate.

- If LDC issued by Assessing Officer after normal slab rate calculation, that rate applies for TDS.

- If NRI seller receives sale proceeds in NRO account and wants to repatriate to NRE account, must submit Form 15CA & Form 15CB.